How Zoning Laws Can Make or Break Your Commercial Real Estate Investment

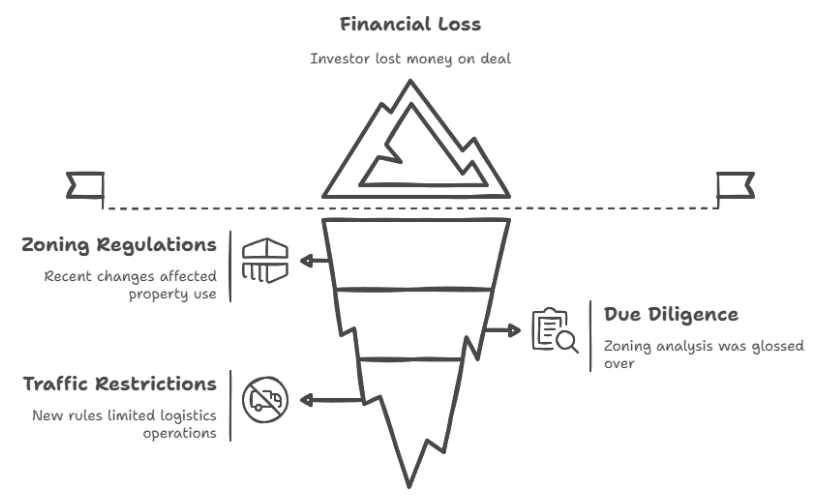

Five years ago, I watched a sophisticated investor make one of the most expensive zoning mistakes I’ve ever seen. He’d found what appeared to be an incredible opportunity: a 40,000 square foot warehouse in an up-and-coming neighborhood, priced at $1.8 million. The building was in excellent condition, the location was improving rapidly, and comparable properties were selling for significantly more per square foot.

The investor was experienced, had closed dozens of commercial deals, and worked with a reputable broker. But in their rush to beat other bidders, they glossed over the zoning due diligence. The property was zoned M1-1 (light manufacturing), which seemed perfect for the warehouse use. What they missed was a recent zoning text amendment that had added new restrictions on truck traffic and loading operations in that specific district.

Six months after closing, when the investor tried to lease the space to a logistics company, the city informed them that the proposed use violated the new traffic restrictions. The cost to modify the building and loading areas to comply would exceed $800,000. Worse, the modifications would reduce the usable space so significantly that the economics no longer worked for most potential tenants.

The property that seemed like a $3.2 million value at acquisition was suddenly worth perhaps $2.4 million – and that’s assuming someone would buy it with the known compliance issues. The investor had turned a seemingly great deal into a nearly $1 million loss, all because they didn’t fully understand how recent zoning changes affected the property’s viable uses.

That experience taught me that zoning isn’t just about whether a use is permitted – it’s about understanding all the regulations, restrictions, and recent changes that affect how a property can actually be operated profitably. Since then, I’ve made zoning analysis a cornerstone of every commercial real estate evaluation I conduct.

What Zoning Really Controls (And Why It Matters More Than You Think)

Most people think of zoning as simply determining whether you can build a restaurant or a warehouse on a particular piece of land. But zoning regulations control far more than just permitted uses – they shape almost every aspect of how a commercial property can be developed and operated.

Building height and bulk regulations determine how much space you can actually build on a lot. A property might be zoned for office use, but if height restrictions limit you to two stories while neighboring properties can build ten stories, that significantly affects the property’s income potential and value.

Parking requirements can make or break the economics of many commercial properties. I’ve seen retail developments that seemed profitable until we calculated that zoning-required parking consumed so much of the site that there wasn’t enough leasable space to generate adequate returns. In urban markets, parking requirements can add hundreds of thousands of dollars to development costs if structured parking is required.

Setback and yard requirements determine how much of your lot can actually be built upon. A property might appear to offer great expansion potential until you realize that required setbacks from property lines leave you with a much smaller buildable area than you expected.

Use restrictions go far beyond the basic categories of commercial, residential, or industrial. Within commercial zoning, there are often detailed lists of permitted and prohibited uses. A property zoned for retail might allow clothing stores but prohibit auto repair shops. Understanding these nuances is crucial for evaluating tenant prospects and rental rates.

Loading and access requirements can significantly impact operational feasibility. Properties that seem perfect for distribution or logistics uses might have zoning restrictions on truck sizes, loading hours, or access routes that make them unsuitable for many tenants in those industries.

Decoding Zoning Classifications: Beyond the Basics

Reading zoning maps and codes requires understanding both the big picture classifications and the detailed regulations that come with each designation. Most municipalities use systems that combine letters and numbers to indicate both the general use category and the intensity of development allowed.

Commercial zones typically range from neighborhood commercial (C1) that allows small retail and service uses, to regional commercial (C4 or C5) that permits large format retail and entertainment uses. But even within these categories, there are often subcategories that allow different uses and development intensities.

Industrial zoning similarly ranges from light industrial that might allow research and development or clean manufacturing, to heavy industrial that permits more intensive manufacturing and potentially hazardous operations. The distinction matters enormously for property values and tenant prospects.

Mixed-use zoning has become increasingly common as cities try to create more walkable, integrated neighborhoods. These zones might allow residential units above ground-floor retail, or combine office, residential, and commercial uses within the same development. While these zones offer flexibility, they also come with complex regulations about the mix of uses, design standards, and parking requirements that can significantly affect development costs.

Special purpose zones address unique situations like airports, universities, or historic districts. These often have highly specific regulations that can create both opportunities and restrictions that aren’t immediately obvious from the zoning designation alone.

The key is understanding that zoning codes are local documents that vary significantly between municipalities. A C-2 designation in one city might allow completely different uses than C-2 in the neighboring town. You can’t assume anything based on the zoning designation alone – you need to read the actual regulations for that specific jurisdiction.

Finding and Interpreting Zoning Information

Most municipalities now provide zoning information online through interactive maps and downloadable ordinances, but navigating these resources effectively requires knowing what to look for and how to interpret what you find.

Zoning maps show the geographic boundaries of different zoning districts, but they don’t tell you the detailed regulations for each zone. You need to cross-reference the map with the zoning ordinance text to understand what’s actually permitted and required in each district.

I always start by identifying the base zoning district for a property, then checking for any overlay zones or special districts that might apply. Overlay zones add additional regulations on top of the base zoning – things like historic preservation requirements, environmental protection standards, or design guidelines that can significantly affect development options.

Recent zoning changes are crucial to understand but often the hardest information to find. Municipalities might update their zoning codes annually or even more frequently, and these changes don’t always immediately appear on online maps. I make it a practice to contact the planning department directly to ask about any recent amendments or pending changes that might affect a property.

Variances and special permits that have been granted for a property create important precedents and rights that might transfer to new owners. A variance that allows a use that wouldn’t otherwise be permitted can add significant value, but it might also come with conditions or time limitations that affect the property’s long-term viability.

Zoning Overlays: The Hidden Layer of Regulation

Overlay zones are one of the most commonly overlooked aspects of zoning analysis, but they can have enormous impacts on property values and development potential. These additional layers of regulation are imposed on top of the base zoning to address specific policy objectives or site conditions.

Historic preservation overlays are common in older commercial districts and can significantly restrict your ability to modify buildings or change their appearance. I worked with a client who purchased a building in a historic district, planning to renovate it for modern office use. The historic preservation requirements added $400,000 to the renovation costs and extended the timeline by eight months. The investment still worked, but only because we factored these costs into our initial analysis.

Environmental overlays might restrict development near wetlands, floodplains, or other sensitive areas. These can limit building footprints, require special construction techniques, or mandate environmental mitigation measures that add significant costs to any development or renovation project.

Transit-oriented development overlays are increasingly common near subway stations or bus rapid transit lines. While these might allow increased density or reduced parking requirements, they often come with design standards and affordability requirements that affect project economics.

Business improvement district overlays can add special assessments or fees that property owners must pay to fund district marketing, security, or maintenance programs. These ongoing costs need to be factored into investment returns and can affect the competitiveness of rental rates compared to properties outside the district.

How Zoning Creates and Destroys Value

Understanding how zoning affects property values requires thinking about it from both a restrictions and opportunities perspective. Restrictive zoning can limit income potential, while favorable zoning can create premium values that might not be immediately obvious.

I’ve seen properties where zoning restrictions artificially depress values, creating opportunities for savvy investors. A property that’s zoned only for specific industrial uses might trade at a discount because of the limited tenant pool, even if the physical characteristics would support more valuable uses with a zoning change.

Conversely, properties with favorable zoning often trade at premiums that reflect their development potential rather than their current income. Vacant or underutilized land in areas zoned for high-density development might be priced based on its potential rather than its current use, requiring careful analysis to determine whether the premium is justified.

Zoning that allows flexible uses typically commands higher values because it expands the pool of potential tenants and uses. A property that can accommodate retail, office, or restaurant uses will generally be worth more than one that’s restricted to a single use type, even if the current income is similar.

Development rights and density bonuses can create significant value that isn’t immediately apparent. Some zoning codes allow property owners to purchase or transfer development rights, creating opportunities to build beyond the normal density limits. Understanding these programs can reveal hidden value in properties that seem fully developed.

The Rezoning Process: High Risk, High Reward

Rezoning can dramatically increase property values, but it’s a complex, time-consuming process with no guarantee of success. I’ve seen rezoning add millions of dollars in value to properties, and I’ve also seen investors spend years and hundreds of thousands of dollars pursuing rezoning applications that were ultimately denied.

The process typically starts with a pre-application meeting with planning staff to discuss the feasibility of your proposal and understand the formal requirements. This informal feedback can save significant time and money by identifying potential issues early in the process.

Successful rezoning applications need to demonstrate that the proposed change is consistent with the municipality’s comprehensive plan and serves the public interest. This isn’t just about what you want to do with the property – it’s about convincing local officials that your proposal will benefit the community.

Community engagement is often the most critical and unpredictable aspect of the rezoning process. Neighboring property owners and residents might oppose changes that they perceive as threatening to property values, traffic patterns, or neighborhood character. Building community support or at least minimizing opposition requires careful planning and often significant outreach efforts.

The timeline for rezoning can vary enormously, from six months in smaller municipalities to two years or more in major cities with complex review processes. During this time, you’re typically spending money on consultants, attorneys, and application fees while the property’s current zoning limits your options for generating income.

Even successful rezoning doesn’t guarantee that your development project will be economically viable. Market conditions, construction costs, and financing availability all change over the months or years required for the rezoning process, potentially affecting the feasibility of your original plans.

Due Diligence: What Every Investor Needs to Check

Zoning due diligence needs to go far beyond just confirming the current zoning designation. I’ve developed a systematic approach that examines not just what’s currently allowed, but what might change and how that could affect the investment.

Current compliance status is the starting point. Just because a property has operated a certain way for years doesn’t mean it’s actually compliant with current zoning. Non-conforming uses might be grandfathered, but they could lose that protection if the use is discontinued or if the building is significantly renovated.

Pending zoning changes can dramatically affect property values, either positively or negatively. I always check with planning departments about any proposed zoning amendments, comprehensive plan updates, or major development projects that might affect the area’s zoning.

Special permits, variances, and approvals that benefit the current use might not transfer to new owners or might have conditions that affect the property’s operation. Understanding these approvals and their transferability is crucial for evaluating the property’s long-term viability.

Neighboring property zoning can affect your property’s value and operations. If surrounding properties are zoned for uses that might be incompatible with your intended use, or if they have development potential that could affect your property’s desirability, these factors need to be considered in your analysis.

Making Zoning Work for Your Investment Strategy

Successful commercial real estate investors don’t just accept zoning as a constraint – they use zoning knowledge to identify opportunities and avoid problems that less informed investors miss.

Value-add opportunities often exist in properties where current zoning allows more intensive or valuable uses than the current operation. A single-story retail building in an area zoned for multi-story mixed-use development might offer redevelopment potential that justifies a higher purchase price.

Timing zoning changes can create significant opportunities for investors who understand local planning processes. Areas targeted for rezoning or comprehensive plan amendments might offer opportunities to acquire properties before zoning changes increase their values.

Risk mitigation involves understanding not just current zoning, but potential future changes that could negatively affect your investment. Properties in areas targeted for downzoning or new restrictions might not be good long-term holds, even if current income is attractive.

Portfolio diversification should consider zoning risk alongside market and property-type risk. Concentrating investments in areas with similar zoning or in properties dependent on specific zoning allowances creates unnecessary risk that can be mitigated through geographic and regulatory diversification.

The Bottom Line on Zoning and Value

The warehouse investor I mentioned at the beginning eventually sold his property at a significant loss, but the experience taught him lessons that have made him a much more successful investor since then. He now spends as much time analyzing zoning as he does analyzing financials, and it’s paid off in deals that others missed and problems that he avoided.

Zoning analysis isn’t glamorous, and it’s often complex and time-consuming. But in commercial real estate, where single decisions can make or cost millions of dollars, understanding the regulatory environment is essential for making informed investment decisions.

The key is developing systems and relationships that help you quickly and accurately assess zoning issues for any property you’re considering. This might involve building relationships with local planning staff, working with experienced land use attorneys, or developing expertise in reading and interpreting zoning codes yourself.

Most importantly, don’t treat zoning as an afterthought in your due diligence process. The time to understand zoning restrictions and opportunities is before you make an offer, not after you’ve committed to a purchase. The cost of thorough zoning analysis is minimal compared to the potential cost of zoning-related problems or missed opportunities.

In commercial real estate, information is power, and zoning information is some of the most powerful data you can have. Use it wisely, and it can help you avoid expensive mistakes and identify opportunities that create significant value. Ignore it at your peril.