How to Make Money in Commercial Real Estate: A No-Nonsense Guide

Ever really thought about how much wealth has been built, consistently, over the years, specifically in commercial real estate? It’s pretty remarkable when you look at the longer-term picture – commercial property has, historically, just performed really well compared to lots of other major investment types. It reliably churns out solid returns for people who understand the game. For the past [Insert Your Number] years, I’ve been lucky enough to be right in the middle of the commercial real estate world. I’ve worked with all sorts of folks, from individuals just getting their feet wet to really big companies, helping them find ways to tap into its pretty substantial profit potential.

What I really want to do in this article is give you a clear, no-nonsense understanding of how people actually make good money in commercial real estate. Whether you’ve been putting money into properties for a while or you’re just literally starting to think, “Hey, maybe this is something,” I want to share some practical, actionable strategies. A bit of that “behind the scenes” perspective, you know? My goal is really to help you navigate what can sometimes feel like a complicated market so you can truly achieve what you’re aiming for financially. Let’s explore what it genuinely takes to build lasting wealth through smart, strategic commercial real estate investment.

Getting the Basics: What Even IS Commercial Real Estate?

Before we really dive into the “how you make money” part, it’s just crucial to get a solid handle on what we’re actually talking about when we say “commercial real estate.”

Defining Commercial Real Estate

Simply put, Commercial Real Estate (CRE) is basically any property that’s used for business stuff. Not where people live full-time, generally. These are the spaces businesses rent to actually operate. You see different types everywhere: office buildings (from small spaces to huge corporate campuses), retail (think stores in a mall, standalone shops, strip malls), industrial places (warehouses, distribution centers, manufacturing sites), and yes, even bigger apartment complexes – once properties hit usually five units or more, they get treated differently from single-family homes in the investment world.

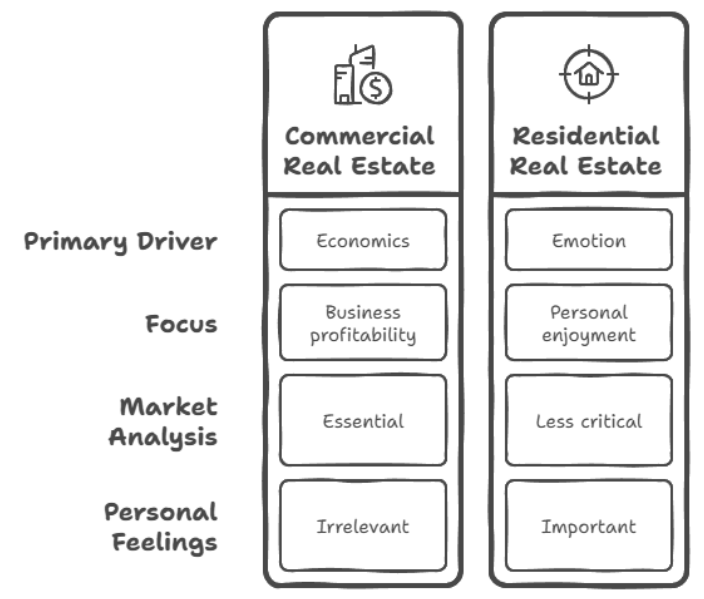

Big difference from residential? Residential is often emotional – you like the house. CRE is driven by economics. It’s about the potential profitability and stability of the businesses that will use the space. You have to understand market trends, check if potential tenants are financially solid, and watch the overall business vibe. Your personal feelings about a building? Not really relevant for CRE investment. It’s about the numbers.

Key Metrics and Terminology

To even talk about this stuff intelligently, you gotta know some core financial terms. They aren’t just fancy words; they’re how you judge a potential deal. A few essential ones:

- Net Operating Income (NOI): The property’s yearly income after cleaning expenses work. Think profit before loans. Formula: Gross Income – Operating Expenses = NOI.

- Capitalization Rate (Cap Rate): Gives you like a percentage rate of return based on income vs. value. Quick comparison tool. Formula: NOI / Property Value = Cap Rate. Be careful comparing Cap Rates without knowing the NOI details!

- Cash Flow: The actual money left for you after everything, including mortgage payments. The “take-home.” Formula: NOI – Debt Service = Cash Flow. Positive is good!

- Return on Investment (ROI): Simple profit measure against your cost. Formula: (Net Profit / Cost of Investment) x 100 = ROI %. Shows capital efficiency.

- Loan-to-Value (LTV): Your loan amount compared to the property’s value. Lenders care about this; it affects your payments. Formula: (Mortgage Amount / Appraised Property Value) x 100 = LTV %.

Honestly, understanding these metrics is vital for smart analysis and choices. Like I always say, knowledge isn’t just power in CRE, it’s genuinely profit.

Making Money Directly: Owning & Running Properties

This is probably the most classic way people make money in CRE – you actually buy the property.

Buying and Leasing

The most straight-ahead way: buy a property, then rent it out to businesses (your tenants). This starts with finding properties that match your goals. Then, it’s critical due diligence. Super thorough. Inspections, market research, deep dive into financials. Once it’s yours, attracting and keeping good tenants is key. Marketing to fill empty spots, negotiating lease terms that work for both sides, and then managing the property proactively.

Commercial leases? They vary a lot, and the type matters big time. A Net Lease (usually NNN) means the tenant pays base rent plus taxes, insurance, and maintenance. Shifts costs to them. A Gross Lease includes most of those in a higher base rent, so you pay the bills out of rent received. Lease types really affect your cash flow predictability. I saw a client switch a retail spot to NNN years ago; it totally stabilized their income because they weren’t exposed to fluctuating operating costs anymore. Big lightbulb moment.

Value-Add Investing

This is buying properties not quite hitting their stride and actively improving them to boost value and income. Think renovating, upgrading systems, maybe even changing the property’s entire purpose to attract better tenants or higher rents. Requires a good eye for potential.

It’s complex – needs budgeting, planning, good project management. But the payoff? Can be huge. Targeted improvements can justify raising rents, reduce vacancies (because the space is nicer), and significantly increase the property value. Compounds your returns. I saw an old office building become a happening co-working space; occupancy and per-square-foot rent soared. Transformation was the key. Just remember, value-add has risk – cost overruns, delays, market shifts mid-project.

Development and Redevelopment

Building brand-new, or significantly overhauling existing structures. Development means finding land, getting permits (long process!), building, then leasing/selling. Redevelopment is transforming something old or useless into something modern and income-producing.

Both need lots of capital, a good team, and high risk tolerance. Zoning battles, securing construction loans, overseeing big building jobs are tough. But success brings substantial profits and long-term value. I worked on converting a massive old warehouse into mixed-use – retail, apartments, offices. Revitalized a whole run-down area, property values nearby jumped. Intense work, but impressive returns for my client.

Making Money Indirectly: Not Owning the Asset Yourself

Maybe the hands-on stuff isn’t for you? No problem. You can still invest.

Real Estate Investment Trusts (REITs)

REITs are a popular, pretty easy way to get CRE exposure without direct ownership hassle. They’re companies that own/operate/finance various kinds of properties – malls, apartments, data centers. Buy shares in a publicly traded REIT, and you own a piece of their portfolio. Less capital needed, no direct management headaches.

They’re structured to distribute a large chunk of taxable income (90% minimum) as dividends. Good for passive income if that’s your goal. Different types exist (owning property, financing property). You get liquidity (can buy/sell shares easily), diversification (they own lots of properties), and professional management. Good for adding CRE to your overall portfolio. Just know dividends and share prices fluctuate with the market and their property performance.

Real Estate Crowdfunding

Newer development. Online platforms connecting developers needing money with individual investors for specific CRE projects. Invest small amounts in maybe a piece of a new apartment building, office reno, retail center development. Lowers the entry barrier significantly.

But risks exist. Liquidity can be an issue – hard to exit until the project finishes (could be years). Absolutely crucial to do homework on both the platform and the specific project. Developer track record, project details, fees – vital info to reduce risk.

Syndications

Another indirect structure. Investors pool money and sometimes expertise to buy larger properties too big/complex for one person. Often structured as an LP or LLC. A “sponsor” or “syndicator” finds the deal, puts it together, manages it day-to-day.

As an investor, you give capital, get percentage ownership, and share profits (rental income cash flow, sale profits). Access to bigger, potentially more profitable deals otherwise out of reach. But, again, risks. Imperative to vet the sponsor carefully – experience, track record, reputation. Understand all terms, fees, and the specific risks of that property and plan before you put in money. Many success stories, but they were based on rigorous vetting of the sponsor and the deal. Can’t stress that enough.

Real-World Examples: Cases That Worked

Seeing how it happened for others really grounds this. Here’s how some strategies played out in real situations I was part of.

Case 1: Fixing Up a Retail Strip in Phoenix: Had a client with a struggling strip mall in Phoenix. Many empty spots, looked dated. My look showed the location was fine, but the tenant mix and look were wrong. Recommended value-add. Got funding (even used some “hard money” to move fast). Worked to attract better, complementary tenants. Upgraded the look – facade, landscaping. Huge change: went from 40% to 95% occupancy in two years! Value more than doubled. Lesson: Even struggling properties can turn around with the right plan and solid execution.

Case 2: Building Apartments in Austin: Client wanted to build multifamily in fast-growing Austin. Land was tough to find & expensive. Used my network/knowledge to find an underutilized parcel not widely marketed; got a favorable deal. My help was key in market analysis (confirming demand), getting development financing (different beast!), and navigating Austin’s complex permits/zoning. Result: A great new complex, filled quickly, good cash flow. Lesson: Find growth markets, have a meticulous plan, even in competitive areas.

Case 3: Updating an Office Building in Denver: Client had an old office building downtown Denver. Struggling against new towers, low occupancy, tenants leaving. Suggested a big repositioning. Major investment in core systems (HVAC, etc.). Modernized interiors – brighter, more flexible. Added modern amenities tenants want now (gym, lounge, maybe even sustainability like solar). Occupancy shot up, boosting income, making it a hot property for eventual sale. Lesson: Strategic upgrades on older assets unlock major profit, attract higher-paying modern tenants.

My Go-To Strategies: Boost Profits, Dodge Risks

Over the years, a few core principles have consistently helped my clients make money and avoid painful mistakes.

- Due Diligence is Non-Negotiable: NEVER skip going deep. Inspections, environmental checks, title searches, rigorous financial analysis. Saw a “sure thing” deal crumble because of hidden contamination. Advising the client to walk saved them millions. Proper checks protect your future cash flow.

- Master Financial Analysis: Get good with NOI, Cap Rate, Cash Flow, ROI. Build models, forecast returns. Analyze the numbers yourself. It helps you ID the best deals for your risk AND spot the bad ones quickly.

- Smart Tenant & Lease Choices: Who you rent to, and the lease terms, totally dictate stability and profit. Vet tenants thoroughly (credit checks!). Negotiate leases carefully – define responsibilities, include rent bumps (escalations), protect your interests. Bad tenants or weak leases mean financial headaches.

- Proactive Management: Good property management isn’t just rent collection. It maintains/enhances value, controls costs, keeps tenants happy (leads to renewals!). Do preventative maintenance. Respond to tenants fast. Review expenses line by line. Diligent management is key for long-term profit.

- Know the Market, Stay Flexible: CRE isn’t static. Know trends, economic conditions, zoning changes. Keep learning. Be ready to pivot – maybe a different property type, a new tenant profile – when the market shifts. Adaptability is vital for long-term success.

- Build a Strong Network: Connect with good brokers (deal flow), lenders (financing), attorneys (legal!), other pros (accountants, appraisers, managers). Your network provides insights, access to off-market deals, help throughout. Consistently see successful investors have strong, trusted networks. Connections make conversions.

- Explore Adaptive Reuse: I love this one. Taking old buildings (mills, warehouses) and giving them new life (lofts, breweries). Saves construction costs often. Inherit cool architecture, maybe great locations. Need feasibility studies. But creative repurposing taps unique markets, can mean big returns.

Bringing It All Together

Commercial real estate truly offers a powerful way to build serious wealth and that passive income everyone talks about. By understanding the basics, checking out different investment paths (owning, REITs, crowdfunding, syndications), managing risks smartly, and using expert insights and a strong network, you can really unlock the potential here. Always remember: diligence, market info, and that trusted network are your absolute best assets.

Feeling ready to look closer at CRE? Reach out! Let’s chat about your goals, find opportunities matching what you want, and build a plan designed to help you succeed. Don’t just dream about financial freedom through real estate; let’s actually pull up our sleeves and build it together with smart, strategic commercial real estate investments!