Commercial Real Estate Valuation: Seriously, Get This Right

It might sound a bit crazy, but did you know some studies suggest over 60% of commercial real estate investments might not hit their original projected returns? And a huge reason for that? Often, it’s simply getting the valuation wrong right at the start. That’s a big number, shows how absolutely vital it is to value property correctly from day one. For more than fifteen years, I’ve been deep in commercial real estate, helping investors, developers, lenders make solid financial calls. Figuring out a property’s true value is a huge part of that.

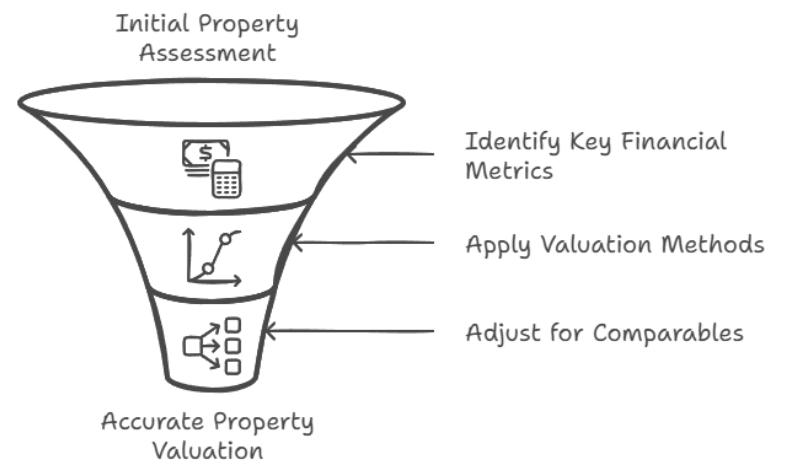

My goal here is to make commercial real estate valuation make sense. I want to show you the methods I use, the key numbers I look at, and drop in some insights from years on the ground. Basically, I want you to feel like you have the knowledge to actually assess property value accurately yourself. That helps lower risk and, of course, boost your potential profits.

The Core Numbers: More Than Just a Price Tag

Before even talking about how to value properties, you gotta get comfortable with the key financial metrics that literally drive pretty much every decision in this business. We’re talking Net Operating Income (NOI), Cap Rate, Cash Flow (simple!), Internal Rate of Return (IRR), and plain old Return on Investment (ROI). Think of these like the property’s pulse. Knowing these numbers gives you a clear picture of its health and its potential to make money. Seriously mastering these measurements isn’t just useful; it’s totally necessary if you want to do well in commercial real estate.

The Big Three Ways to Value Property

When you actually put a number on commercial real estate, there are three main ways, three foundational methods almost every pro uses. They are: the Sales Comparison Approach, the Income Capitalization Approach, and the Cost Approach. Each gives you a different angle on a property’s value. That’s why you need all three in your toolbox. Knowing when and how to use each one right is key to getting accurate results.

Breaking Down the Methods: How They Actually Work

Let’s look closer at these three core ways to value property.

Sales Comparison Approach: Looking at What Sold

This one feels pretty natural. You figure out a property’s value by comparing it to recent sales prices of similar properties nearby. Idea is simple: a smart buyer won’t pay more for one property than they would for another, super similar one. The tricky part? Finding sales that are truly “comparable” for commercial properties. They aren’t often identical!

Commercial properties differ in size, age, features, exact spot. This is where “adjustments” come in. If a similar property sold with a feature yours doesn’t have (extra loading dock), you subtract value from its sale price to match yours. If yours is better (better visibility, more parking), you add value to the comparable’s price. I used this for a retail client in Dallas. Found recent sales of similar buildings nearby, got a baseline. Used small differences (like better road access for ours) to justify our price and even negotiate better. This method works best when there are good, recent sales of pretty similar properties around. Makes adjustments easier.

Income Capitalization Approach: It’s About the Money

This is the go-to for properties bought to make income. It focuses straight on how much money a property can earn. Great for office, retail centers, warehouses, apartments – anything leased to tenants. The core is the Net Operating Income (NOI) we talked about. It’s the yearly income minus typical operating costs (taxes, insurance, maintenance, management). Remember, it’s before mortgage or income tax. You figure out the property’s value by dividing the NOI by a Capitalization Rate (Cap Rate). That Cap Rate reflects the return investors expect for similar-risk properties in that market.

Projecting future income accurately is vital here. Think about future occupancy, when leases expire, likely rent increases, how costs might go up. Picking the right Cap Rate is just as key. You usually get it by looking at Cap Rates from recent sales of comparable income properties. Used this for an investor looking at an apartment complex. Analyzed history, projected future income carefully, applied a solid Cap Rate from other sales. Showed the property was actually undervalued based on its earning power. They bought it, did great. Also, looking at Discounted Cash Flow (DCF) models is part of this; projects cash flow over years and brings it back to today’s value.

Cost Approach: How Much to Build It New?

The third method. Estimates value based on the cost to replace it with a similar new building today, then subtracts value lost from age or problems. Assumption: a smart buyer won’t pay more for an old building than a new, equal one would cost. Step one: figure out today’s cost to build it. Step two: subtract depreciation (physical wear, also outdated design, bad external factors). Step three: add the market value of the land.

Seems simple, but tricky for commercial buildings. Figuring out depreciation, especially on older, complex properties, is rough and subjective. Also, it doesn’t always factor in market demand. For really unique or old buildings where comparing sales is hard and depreciation is a guess, Cost Approach alone is less reliable than the others. Good for newer buildings or specialized stuff where there aren’t many similar sales. Knowing its limitations is important.

Watch Out! Don’t Fall Into Valuation Traps

Even knowing the methods, it’s easy to mess up valuation. I’ve seen too many costly errors from simple mistakes.

Big one? Using old data. Markets move fast. Using old sales or rent numbers can give you a totally wrong picture of today’s value. Always use the newest data you can find.

Ignoring market changes is another trap. How’s the economy? Interest rates? Is a ton of new construction coming? These things dramatically impact values, sometimes fast. Don’t ignore outside forces.

Not doing proper due diligence is huge. Valuation isn’t just spreadsheets. It’s inspecting the building physically (catch needed repairs the seller won’t mention), checking financials thoroughly, looking for environmental issues (hidden costs!). Saw a deal almost go bad because the original appraiser missed major maintenance needed. Valuation looked high, but real value was way lower after accounting for repairs. My analysis saved them.

Finally, tough one: letting emotions creep in. It’s easy to get excited about a property. But you must stay objective. Base value on numbers, market data, the property’s real condition – not on wanting the deal badly. Avoid these mistakes, stay disciplined, and seriously, get expert help when you’re unsure. A pro gives you that necessary objective view.

Real Stories: Valuation in Action

Let’s see how this plays out with examples from my work.

Case 1: Retail Strip Comeback (Phoenix, AZ): Client bought a beat-up retail center. Initial valuations were low based on low current income (lots empty). But we saw demand for certain retail types nearby. Projected higher future income post-renovation. Used Income Cap, but on the projected (higher) future income. Showed lenders and client it was undervalued based on potential, not just current state. Client got financing, repositioned it, actual income soared, value jumped. Lesson: Don’t overlook future potential in valuation, especially for value-add!

Case 2: Office Buy in NYC: Client eyed Manhattan office building. Price seemed high. Limited sales of really similar buildings, making Sales Comp tough alone. Dug deep: analyzed income/expenses, used a more complex Discounted Cash Flow (DCF) model over years. Showed price was likely too high based on future cash flows. Advised lower offer. Seller said no, then later came back and accepted the lower price after facing vacancies. Lesson: Rigorous financial analysis (like DCF) is powerful in competitive markets, helps you trust your numbers and be patient.

Case 3: Industrial Warehouse Value (Chicago, IL): Client needed value for a warehouse to sell. Pretty new, great condition, but few recent sales of that specific size/type nearby. Sales Comp challenging. Used Cost Approach as primary method with construction cost experts. Cost to build that specific modern warehouse today, minus minimal depreciation (it was new), plus land value. Gave a solid baseline value. Supported it with limited modified Sales Comp data. Combined, gave a well-supported value for client’s sale discussions. Lesson: Use the best method for the property/market, sometimes combining works best.

These show you gotta know the methods, pick the right one (or ones), do real due diligence (beyond paper!), and get expert help when you’re on shaky ground. Every property is unique. Need a nuanced approach.

Wrapping It Up: Get Your Valuation Right

So, accurate valuation isn’t just a step in commercial real estate; I truly believe it’s the absolute base for any successful investment. Learning the Sales Comp, Income Cap, Cost approaches, understanding NOI and other numbers, and watching out for those common mistakes – this sets you up to navigate the market smartly. To make informed, hopefully very profitable, decisions.

Don’t just guess on commercial property value. It’s too much money to leave to chance. If you want to get better at this, gain that edge, feel more confident in your decisions, I’m here. I do personalized consultations to help you look at properties right, using these methods, finding the best strategy for your goals. Let’s work together. Let’s turn those aspirations into successful realities by getting the numbers right. Contact me today. Let’s look at your next potential property.