Analyze Commercial Leases: Expert Tips for Tenants & Landlords

It’s astounding, isn’t it, how many commercial tenants find themselves regretting their initial lease agreement down the road? You might be surprised to learn that the number jumps to over 70% of commercial tenants! This isn’t just some academic statistic; it’s a very real situation that underscores the critical, and often overlooked, importance of deeply understanding your commercial lease. A commercial lease agreement is far more than just a stack of papers. It’s the bedrock upon which the daily operations of your business will rest. A misstep here, a misunderstood clause there, and you could potentially trigger significant financial and operational headaches that could have easily been avoided.

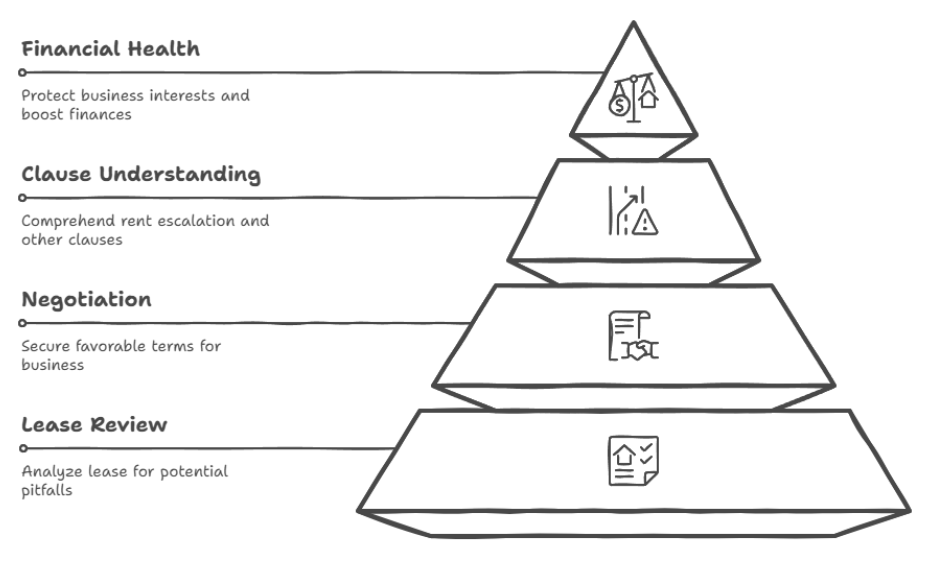

Over the years, as a commercial real estate professional, I’ve spent a good deal of time getting to know everything about commercial leases. I’ve had the pleasure, often enough, of helping businesses secure favorable terms, but more often than not, I’ve helped them avoid costly mistakes. Believe me, I’ve seen firsthand just how a lack of understanding can cripple a business’s growth potential to what lengths a well-negotiated lease can do to set the stage for long-term success. My intention here is to empower you with the essential knowledge and the right tools that you’ll need to analyze a commercial lease like a seasoned pro. I want to ensure that you’re able to make informed decisions, protect your business interests, and boost your business’ financial health. Together, we can cut through the complex jargon, identify and neutralize potential pitfalls, and unlock the secrets needed to secure a commercial lease that works for you, not against you. This means covering elements like the commercial lease review, lease agreement negotiation, and understanding specific lease clauses like rent escalation.

Decoding Commercial Lease Jargon

Let’s be honest: one of the most challenging aspects of analyzing a commercial lease has to be the mind-numbing volume of legal jargon. It can often feel like you’d need to spend a year in law school just to fully grasp what you’re actually and truly signing! But here’s the good news: I’m here to distill some of the most common (and, frankly, most confusing) commercial real estate terms into a language that’s plain, simple, and easy to understand. Consider this your personal cheat sheet on navigating the complex, and sometimes quite treacherous, lease landscape.

Okay lets dive in. Let’s start with CAM. CAM, as in, Common Area Maintenance. These are the fees that you’ll be charged in order to cover the costs needed to maintain shared spaces. Think hallways, lobbies, parking lots, even landscaping maintenance. Next, you’ll likely encounter Rent Escalation clauses, and these dictate how and when your rent will increase over the time that you’re lease is in effect. Understanding this, especially for long-term projects, is absolutely crucial to effective financial planning. Another super, super important term? Permitted Use, a term which defines the specific type-and scope-of business that you are permitted to operate within the confines of the commercial space. And finally there’s Exclusive Use, which grants you the absolute and sole right to operate a particular type of business within the property, thus preventing your landlord from leasing the space to direct competitor, which can be a major win.

I remember one case where a client of mine was on the cusp of committing to a lease, but without fully grasping what all of the CAM fees included. The lease language was exceedingly vague. It simply stated “tenant responsible for pro-rata share of CAM.” After digging deeper, we learned that the landlord was laying the groundwork for a major renovation of the common areas, including adding a fountain in the front, which consequently would have resulted in a significant spike in CAM fees, essentially doubling his client’s rent. By understanding the jargon and the underlying implications, and by asking some pointed, strategic questions, we were able to negotiate a cap on the CAM fees, which ended up saving my client tens of thousands of dollars over the lease’s full term. That’s the power of understanding the language and the subtext, and it’s all about being able to protect your interests and make sound, informed decisions. What strategies have you found most helpful in understanding lease jargon? I know I found that it’s particularly useful to consult with a commercial real estate attorney that specializes in tenant representation.

Key Clauses to Scrutinize

While understanding the jargon is, without a doubt, crucial, knowing precisely which clauses to pay the closest attention to is equally important. Not all lease clauses are created equal, and some, truthfully, can have a far more profound impact on the overall long-term success of your business than others. Think of these as your “deal-breaker” clauses, the ones that can either make or break your lease agreement and, therefore, your long-term business prospects.

First and foremost, you need to take a hard look at the clauses that directly relate to both rent and operating expenses. And that means you’re not just looking at the monthly base rent, you’re also looking at CAM fees, insurance costs, and, of course, property taxes. I find that clearly delineating exactly what the responsibilities are of the landlord versus the tenant are essential to preventing future disputes, especially in regards to larger and potentially costly expenses. Things such as structural repairs, things like the plumbing and the wiring, and even seemingly simple things everyday maintenance. Pay close attention to how these expenses are calculated, that’s important, how often the can be adjusted, and most importantly, perhaps, are there any caps or limitations on any increases? A seemingly small adjustment in CAM fees, even on the surface, can considerably impact your bottom line for better or worse. A standard lease clauses include a portion that states a landlord may possibly be responsible for structural repairs, while the tenant is responsible for all everyday maintenance and overall property upkeep. So you need to determine what’s specified in your lease agreement.

Another critical area of emphasis should happen with Permitted Use clause, which dictates how you can legally use the space. So if you think that your business will eventually require future expansion or offer new products or services down the road, you need to ensure the Permitted Use clause is broad enough that it can reasonably accommodate those changes. I actually have seen businesses get into hot water because they violated of this clause in different ways, for instant, hosting special events that weren’t explicitly permitted in the wording of the lease. Furthermore, you’ll definitely want to examine carefully at clauses regarding both subletting and assignment. These become very, very key important, especially if you think you might need to move locations or you need to downsize before the end of the current lease agreement. Any restrictions on subletting or assignment can leave you in a precarious position, stuck paying rent on an empty space.

Before you commit to signing a commercial lease, it’s essential that you ensure that you have carefully reviewed each of the clauses mentioned above. And perhaps a handy checklist may be very helpful. It will allow you to keep all of your notes organized throughout this process. Make sure you include things like CAM fees, property taxes, any stipulations regarding the permitted uses, and regulations regarding subletting and assignments, these are all very important. How do you keep all the specifics of you lease organized? By understanding all the critical elements of your commercial lease early on, it’s absolutely key to running a successful and smoothly operated business… and remember that these clauses are often negotiable, and that your full level of understanding of is your greatest negotiating tool.

Financial Due Diligence: Beyond the Base Rent

It’s incredibly easy to become fixated on the the base rent you need to pay to evaluate a commercial lease, but that isn’t the only important piece of the puzzle. To truly understand the financial implications of a lease, you’ve simply got to perform thorough due diligence and look beyond the bottom line rental rate. Simply put, failure to do so can lead to some unpleasant surprises and also significantly impact the profitability of your business.

The first step is to actually calculate the total cost of the lease agreement. This includes more than rent, such as CAM fees, local and state property taxes, insurance, and any other relevant expenses. Don’t forget to factor in any rent escalations that are scheduled that are scheduled to take place over time of the lease as well. What techniques do you personally use to stay on track? Once you have a clear picture of the overall cost, you can begin projecting your prospective expenses. Look at historical data and the surrounding area to estimate how much expenses, insurance, and taxes are expected to increase overtime.

Assessing the financial viability of the lease for you and your business is essential. Consider your business’s estimated revenue, expenses, and profit margins. I once advised a client was so excited by the prospect of a prime location, but overlooked the high CAM fees, that were tied to the landlord’s upcoming plans. We realized the lease wouldn’t be possible for the current state of their business.

Negotiation Strategies: Levers You Can Pull

The prospect of negotiating a commercial lease can be intimidating. However, the truth is that you have more leverage than you think. First, be prepared.

One of the most effective negotiation strategies is to research market rental rates for similar properties, giving you a strong basis to argue that the landlord’s is too high. Another approach is to identify the landlord’s priorities. Finally, be creative. You can negotiate concessions like free rent, a tenant improvement allowance, or a cap on CAM fees. Understanding the letter of intent beforehand will allow you insight into the landlord’s expectations.

Navigating Landlord-Tenant Responsibilities

A solid commercial lease is founded from establishing mutual responsibility. Understanding different maintenance duties is key to a working relationship.

Typically, the landlord is responsible for maintaining the structural integrity of the building, including the roof, foundation, and exterior walls. As the tenant, you’re typically responsible for maintaining the interior of your leased space, including repairs to plumbing, electrical systems, and fixtures within your unit. Always review the lease regarding specific accessibility responsibilities.

Over the years, clear language is crucial for smooth business and long-term success. Making a communication relationship with both parties involved is key.

Case Studies: Real-World Examples of Lease Analysis

Commercial lease agreements can be complex documents with significant financial implications for both landlords and tenants. Analyzing these agreements requires a keen eye for detail and a deep understanding of real estate law and financial principles. Here are a couple of case studies illustrating how expert lease analysis can uncover hidden costs, negotiate favorable terms, and ultimately protect a client’s bottom line.

Case Study 1: Uncovering Hidden Common Area Maintenance (CAM) Expenses

A retail tenant was concerned about steadily increasing CAM charges in their triple-net lease. A thorough lease analysis revealed that the property management company was improperly allocating maintenance costs. Specifically, the lease did not clearly define the separation of time spent by maintenance personnel on common area upkeep versus tenant-specific work orders. Because one tenant pointed out that the property management was unable to make this distinction, the expense was removed from the NNN’s passed through to all the tenants [leaseprobe.com]. By identifying this discrepancy, the tenant was able to negotiate a significant reduction in their CAM charges, resulting in substantial savings over the remaining term of the lease. This highlights the importance of carefully scrutinizing CAM provisions and ensuring accurate cost allocation.

Case Study 2: Negotiating Favorable Terms for Expansion and Flexibility

A growing business sought to expand its operations within a retail space. The initial lease agreement contained restrictive use clauses that would have limited the company’s ability to offer new services and partner with other retailers. Careful analysis of the permitted use clause allowed the business to expand to offer yoga and weightlifting classes, when initially they only offered spinning [theretaillawgroup.com]. By identifying these limitations early on, the tenant was able to negotiate broader permitted use clauses, allowing for future expansion, seasonal events, and potential co-leasing opportunities. This proactive approach ensured the lease would accommodate the company’s evolving business needs and maximize its long-term potential.

Navigating the world of commercial leases can be tough. But by having a plan of action and following the necessary protocol, the process can be easier.

Contact me today for a free consultation so together we can ensure that your lease sets you up for success!